Title:

Electric Saints and Silicon Kings: Tesla, Elon Musk, and the Cult of Optimized Failure

Dear readers, what happens when innovation becomes religion, and its prophets begin to falter—not in silence, but with the entire world watching?

Elon Musk is at it again—or rather, still. In a week that should have been dominated by cold. hard. numbers. from Tesla’s Q1 earnings, the real heat came from somewhere else: Musk’s ability to sidestep cold reality with hot promises. Tesla stock surged. Why? Not because the numbers were pristine—they weren’t—but because investors decided, yet again, to believe.

Earnings Be Damned, Long Live the Dream

Tesla didn’t deliver a financial masterpiece this quarter. Margins dipped. Automotive revenue softened. Growth wasn’t dead, but neither was it thriving. And yet? The markets forgave. They didn’t just forgive—they rewarded.

Because Musk, ever the oracle of engineered futures, dangled carrots of electric salvation: robotaxis, FSD (Full Self-Driving), humanoid assistants. In essence? A deus ex Machina still in beta.

Brian Mulberry of Zacks Investment Management called Tesla “still profitable” and championed its margins as “the highest per unit in the auto business.” He’s not wrong. But here’s the cultural catch: Tesla isn’t winning on performance. It’s winning on perceived inevitability.

Elon as Entertainment: The Cult Leader of Capitalism

The line between CEO and celebrity has long faded. Musk doesn’t just helm a company—he performs it. His Twitter musings cause market waves. His facial expressions on earnings calls are dissected like papal hand gestures. Like reality TV gone public, his triumphs and tantrums are monetized in stock ticks.

Jim Cramer recently urged Tesla to “bring on the humanoids,” a line both absurd and deeply telling. This isn’t a business discourse anymore. It’s fandom dressed in finance. Musk isn’t beholden to quarterly logic—he’s threading a narrative through quarterly theater.

The Fidgety Faith of a Disrupted Market

There’s a term we whisper about in media studies: optimism laundering. It’s where brands turn future potential into current value. Tesla epitomizes this. Their Power unit, we’re told, “grew 180% over the past three years”—but still only accounts for ~10% of revenue. Somehow, that sounds amazing. And that’s the point: it doesn’t have to be amazing. It just has to cast the right kind of shadow.

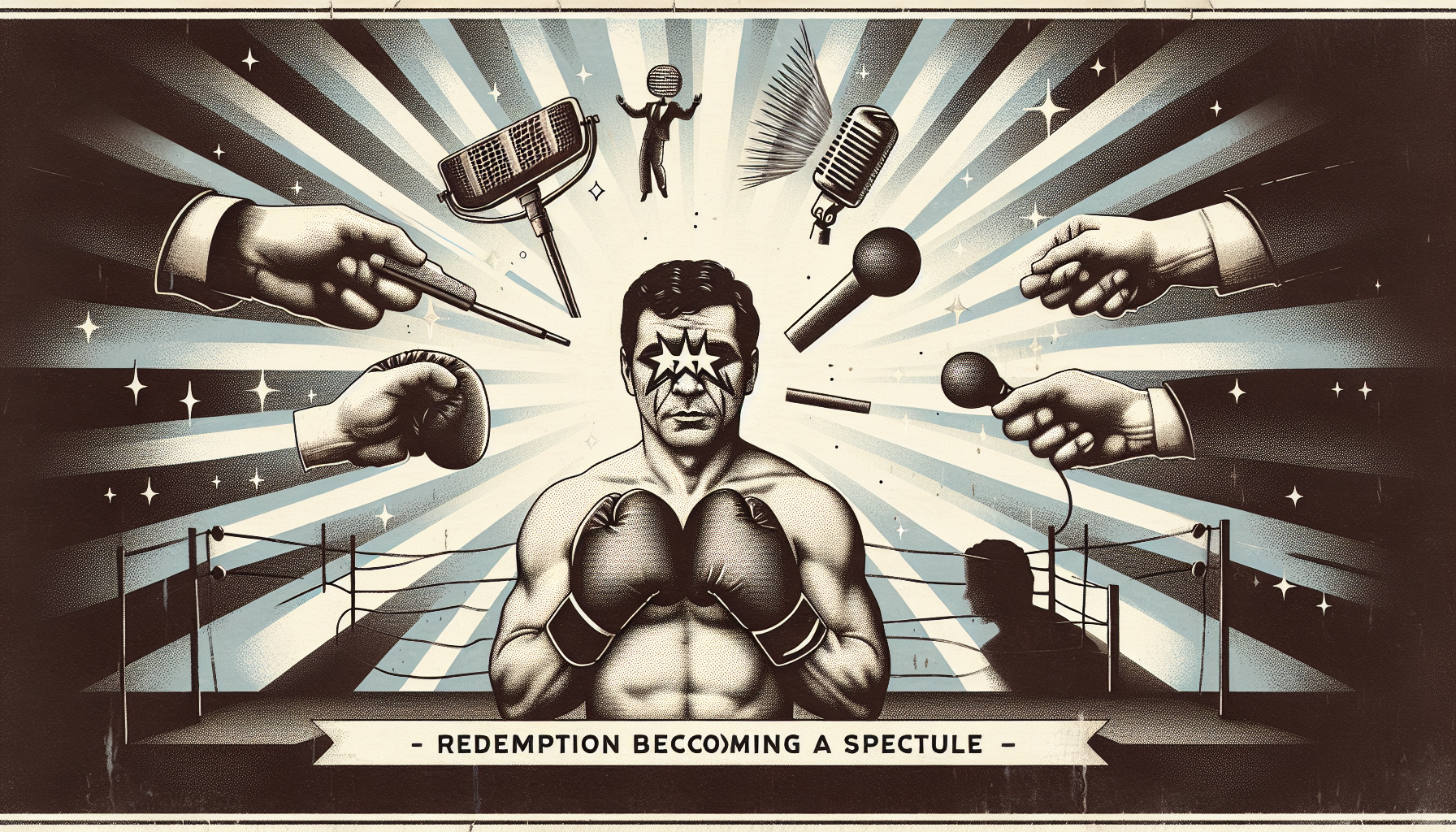

Compare this, if you will, to the Mickey Rourke of the markets—a once-brilliant actor stumbling into televised collapse, reputation spinning on the axle of his own volatility. But Elon? He fumbles forward, and the world calls it tap dancing. He burns cash, and they call it forging ahead.

This isn’t just Tesla. It’s a system built to reward spectacle over substance, momentum over maturation.

What Remains After the Gospel of Growth?

The tragedy—or brilliance—of Tesla is that it’s no longer just a car company. It’s an idea. A belief system. A channel through which we project our guilt, our hopes, our faith in technology when we’ve stopped believing in anything else.

And like any faith, it demands belief over proof. Achievement becomes secondary. What matters is the story.

So, what are we really buying when we buy Tesla stock?

A car? A return on earnings?

Or a little piece of modern mythology, autobranded into our psyches like a shiny savior with autopilot?

Until next time, dear readers—stay skeptical.

In the era of electric grins and algorithmic gods, hope is a luxury. Discernment is a duty.

Yours in digital dust,

A Watcher of Markets & Messiahs